School of Business

Accounting

Bachelor of Business Administration (B.B.A.)

Cultivating Innovative Leaders for a Sustainable Society

Our accounting program experiences 100% of our accounting students gaining employment within one year from graduation. The Accounting program at Woodbury dates back to 1884, making it one of the oldest accounting programs in Southern California.

Contact Us: [email protected]

Apply Request Information Take a Tour

Why Study Accounting

Students studying accounting learn how to make important high-level financial decisions. Accounting majors can shift from working for a business to becoming an independent entrepreneur to achieve upward mobility.

Newt D. Becker Scholarship: Becker Accounting

Apply for the Newt D. Becker Scholarship from Becker Accounting to help start your CPA journey. To learn how to apply, please visit the link below. Scholarship application deadline is March 1st.

https://www.becker.com/cpa-review/newt-d-becker-scholarship-program

Accounting Courses

Students cannot master the accounting practice by simply taking multiple-choice exams. Rather, we provide stimulating classroom instruction based on outcome focused experiences and industry trained professionals.

MGMT 100 Fundamentals of Business Enterprise

This course allows students to discover how a business works and how it impacts society. Business is studied as an integral part of a total social, political, and economic environment in all its various functional areas: accounting, finance, management, marketing, human relations, and how these areas interact. It explores how entrepreneurs find, screen, and evaluate ideas for new business opportunities. A key part of the course focuses on student teams’ development of a business plan for a new venture. Prerequisites: None.

MGMT 110 Legal Environment Of Business

This course prepares students to make viable decisions within a legal and ethical framework. Subjects include the nature of law and legal process, business and the regulatory environment, administrative law of contracts and torts, statutory and common law, antitrust, partnerships and corporations, environmental law, consumer protection, and employment law. Prerequisite: WRIT 111, Academic Writing I.

ACCT 205: Financial Accounting for Decision-making

Principles of accrual accounting, basic processes of financial record keeping, and use of the basic financial statements. Emphasis is on learning the strengths and weaknesses of financial accounting in order to better use accounting information to make financial decisions. Prerequisites: MGMT 100, Fundamentals of Business Entrepreneurship, MGMT 110, Legal Environment of Business, WRIT 111, Academic Writing 1, COMM 120, Public Speaking, and MATH 220, Business Math or MATH 249, College Algebra.

ACCT 206: Managerial Accounting for Decision-making

Accounting methods and issues applicable to equity of partnerships and corporations, accounting for current and long-term debt, managerial accounting, including inventory costing, capital and operational budgeting, and break-even analysis. Prerequisite: AC 205, Principles of Accounting I.

MGMT 301 Principles of Marketing

This course focuses on the practice of written and oral skills as applied to human relations in a business or non-business organizational setting. Emphasis is on the principles of effective listening and perceptual processes in communications, including an awareness of current issues such as the role of electronic media and communication processes within an organization. Prerequisite: WRIT 112, Academic Writing II.

MGMT 326 Management and Organizational Behavior

This course is a comprehensive overview of the management process and organizational behavior. The focus of the course is on understanding and managing human behavior in organizations. Topics include: fundamentals of planning and organizing, organizational culture and leadership, motivation, communication, managing across cultures, ethics and social responsibility, human resource skills, teamwork and group dynamics, diversity, power and politics, authority and influence, and managing change and conflict. A high level of participation is garnered through the use of cases, simulations, discussion, and viewing the class itself as a virtual organization. Prerequisite: MGMT 100, Fundamentals of Business Enterprise. Co-requisite: WRIT 112, Academic Writing II or WRIT 212, Rhetoric and Design.

ACCT 300: Cost Accounting

In-depth study of: product costing, including job-order, process and standard costs, variance analysis, and cost-volume-profit analysis. Prerequisite: AC 206, Principles of Accounting II or ACCT 206, Principles of Accounting II.

ACCT 304: Intermediate Accounting I

A concentrated study of accounting within the conceptual framework which underlies financial reporting, with emphasis on accounting issues related to asset valuation and reporting, including time value of money concepts and long-term obligations. Prerequisite: AC 206, Principles of Accounting II, or ACCT 206, Principles of Accounting II.

ACCT 305: Intermediate Accounting II

Examines accounting issues for long term obligations, income taxes, pensions, leases, error correction, accounting changes, income recognition, financial statement analysis, cash flow statement, and owners’ equity and earnings per share. Prerequisite: AC 304, Intermediate Accounting I or ACCT 304, Intermediate Accounting I.

ACCT 352: Concepts of Taxation

An introduction to a broad range of tax concepts and types of taxpayers covering the role of taxation in the business decision-making process; basic tax research and planning; professional standards and ethics; and the interrelationship and differences between financial accounting and tax accounting. Prerequisite: AC 206, Principles of Accounting II or ACCT 206, Principles of Accounting II.

ACCT 388: Advanced Business Law

This course examines key legal doctrines and rules governing organizations. Emphasis is on analyzing open-ended, lifelike fact patterns (i.e. case studies) to identify and complete appropriate standard legal forms. Prerequisites: ACCT 205, Financial Accounting for Decision Making and MGMT 110, Legal Environment of Business.

ACCT 403: Government and Not-For-Profit Accounting

Fund accounting, study of the accounting literature applicable to governmental units and to not-for-profit entities such as colleges, universities and hospitals. Prerequisite: AC 305, Intermediate Accounting II

ACCT 410: Auditing

This course will examine financial auditing practices and procedures. Professional standards of practice and reporting are also explored. Prerequisite: ACCT 305, Intermediate Accounting II.

MGMT 400: Operations Methods in Value Chain Management

Value Chain Management looks at the entire stream of value-adding units and activities in an organization. The categories include primary line-management activities from inbound logistics, production, marketing and sales, outbound services, and return actions. It also includes staff functions such as HR, infrastructure concerns, development, and purchasing. The course focuses on the quantitative techniques utilized by managers in these areas for problem solving and decision making in business, including areas such as linear programming models, inventory and production models, decision making and project scheduling under certainty and uncertainty, transportation and trans-shipment techniques, decision tree construction and analysis, and PERT/CPM. Prerequisites: MATH 220, Business Mathematics or MATH 249, College Algebra; MATH 226, BusinessStatistics; MGMT 336, Management of Information Systems; and FINA 360, Financial Management.

MGMT 461: Leadership Theory and Practice

This course provides an examination of current theory in the burgeoning field of leadership studies, emphasizing leadership skills and their place in human resources management. Ideas of self-awareness, understanding the role of the leader, and sensitivity to individuals and groups will be taught. Students will learn the significance and implementation of vision statements and engage in a study of inspiration versus domination and motivation versus manipulation. Students will also explore the creation of positive self-image and group identity. Course activities include lecture, case study, experiential exercises, and group process. Lecture. Prerequisites: MGMT 326, Management and Organizational Behavior; MGMT 350, Business Ethics; and WRIT 112, Academic Writ-ing II or WRIT 212, Rhetoric and Design.

MGMT 483: Business Policy and Strategy

This course is the “capstone” course for business majors. It provides an opportunity to integrate previous studies in the functional areas of marketing, finance, accounting, production, and management. Organizations are analyzed with respect to the effectiveness and appropriateness of strategies and goals in each of the functional areas and the synergies of those areas for achieving opTimal results consistent with their respective missions. The major topics covered include competitive analysis, the strategic management process, the role of the chief executive officer, strategy formulation and decision making, and strategy implementation. Lecture. Prerequisites: Senior standing; MGMT 400, Operations Methods in Value Chain Management; and WRIT 112, Academic Writing II or WRIT 212, Rhetoric and Design. Note: A minimum grade of “C” or better in this course is required to graduate.

ACCT 351: Advanced Taxation

Study of Federal Income Tax Law applicable to corporations, partnerships, trusts, gifts, and estates. Prerequisite: AC 305, Intermediate Accounting II or ACCT 305, Intermediate Accounting II, or consent of instructor.

ACCT 353: Entertainment Industry Accounting

Accounting and management applications specific to the motion picture industry, with general use in all other areas of media production, including television, commercials, music videos, and games development. Specific topics include production budgeting, management reporting, film terminology, and studio distribution contacts. Financial reporting requirements promulgated by the American Institute of CPAs and the Financial Accounting Standards Board will be discussed. Prerequisite: AC 206, Principles of Accounting II or ACCT 206, Principles of Accounting II, and junior standing.

ACCT 401: Advanced Accounting

Business combinations; inter-company transactions; foreign currency transactions and financial statements; partnership formation and liquidation; introduction to government and not-for-profit accounting. Prerequisite: AC 305, Intermediate Accounting

ACCT 405: Accounting Systems

Study of the application of computer processing to accounting procedures; includes control mechanisms and procedures to maintain the integrity of data and the effective reporting of information. Prerequisite: AC 206, Principles of Accounting II or ACCT 206, Principles of Accounting II.

ACCT 470: Topics

Accounting subjects or developments of interest not elsewhere covered. Prerequisite: AC 304, Intermediate Accounting I or ACCT 304, Intermediate Accounting I.

ACCT 485: Accounting Problems

Review of current accounting theory and the problems used to test the understanding and application of that theory in professional examinations. Prerequisites: AC 300, Cost Accounting or ACCT 300, Cost Accounting, and AC 305, Intermediate Accounting II or ACCT 305, Intermediate Accounting II.

Top Reasons to Study Accounting at Woodbury

Interactive Experiences

We provide interactive assignments to help students think in outcomes rather than in tasks and to-do lists.

Our curriculum helps students become results-oriented to achieve organizational growth and to create profitable bottom-lines.

This creates meaningful resumes for our students as they are seen as achievers who can move organizations forward.

Professionally Trained Faculty

Our faculty members represent highly regarded scholarly academics and practitioners.

They possess strong academic background with scholarly works published in leading academic journals.

Our faculty brings extensive experience in the field (i.e. working for the IRS for more than 30 years). In addition, adjunct faculties own and operate their accounting practice and are locally recognized within their communities.

Resources for Accounting Majors

- Accounting Society – student organization; provides strong industry connections and alumni.

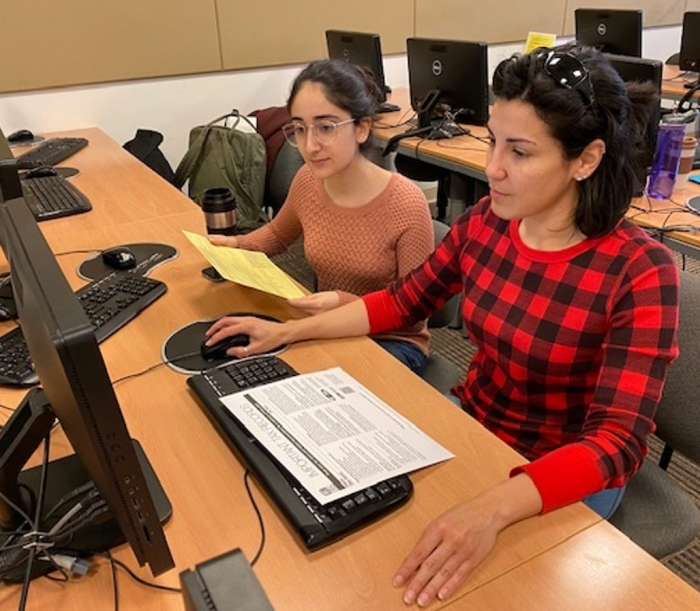

- VITA (Voluntary Income Tax Assistance) – opportunities for real tax work.

- Meet the Firms networking events for internships and employment opportunities

- Paid internships widely available in the local area

- Research, field work, and independent study

How to Become a CPA in the State of California

Step 1: To Sit on the CPA Exam

- Bachelor’s Degree (Any major, but an Accounting major is the most suitable for the education background listed below.)

- Educational Background

- 24 Semester Units of Accounting Subjects

- 24 Semester Units of Business-Related Subjects

- 20 Semester Units of Accounting Study

- 10 Semester Units of Ethics Study

Step 2: To Get Licensed

- One year of working experience in accounting

- 150 hours of coursework (any coursework)

Common Pathways to Become a CPA

- Obtain a Bachelor’s degree in Accounting

- Begin a job in accounting firm after obtaining your Bachelor’s degree

- Take the CPA exam while working at an accounting firm (you must pass all four sections within two years)

- Take additional 30 hours of coursework (total 150 hours) during the pre/post exam period (even before your Bachelor’s degree [community college hours that are not transferred are acceptable]). Pursuing an advanced degree such as a MBA is acceptable and suitable for your career.

- As soon as you fulfill a total 150 hours of course work, you become a CPA.

Become an Entrepreneur with Accounting

Whether you are an accounting major or if you aspire to start your own business, entrepreneurs must comprehend necessary accounting and finance tools to:

- Make insightful trends and recognize outliers to make future predictions

- Allocate business resources appropriately to attract customers, to deliver just-in-time response systems to satisfy demands of customers, and to improve production processes to scale businesses more efficiently

- Measure and improve operational progress to achieve profitability and to pivot in strategy, when necessary, to optimize operational excellence.

Listen to an interview with Accounting student, Ruxandra Badilas

Learn how she turned an internship with the ‘Big 4’ accounting firm EY into a full time job.

A Message from our Accounting Coordinators

Jeff Neumeister, MBA, MAcc. & Alice Shiotsugu, DPA

Our program’s goal is to help anyone develop a satisfying and rewarding career. Accounting is a fantastic major, whether you are interested in public accounting, small businesses, tax, or want to start your own firm. Feel free to reach out to us to talk about the program!

Email Jeff Neumeister at [email protected].

Email Alice Shiotsugu at [email protected]

Accreditations

AACSB International: The Association to Advance Collegiate Schools of Business

ACBSP: Association of Collegiate Business Schools and Programs

WSCUC: Senior College and University Commission (formerly WASC)

CPA Disclosure

The Bachelor of Business Association (BBA) in Accounting at Woodbury University’s School of Business (WUSB) comprises 120 credit units, which allows graduates to sit for the Uniform Certified Public Accountant (CPA) Exam in California. However, the state boards of accountancy require students to complete 150 academic credit units to be eligible to become a licensed CPA.

For a full list of California CPA licensure requirements, please visit This Way to CPA, California. Other states may have additional educational and/or non-educational requirements.

Before enrolling at Woodbury University, prospective students must review the Accounting Professional Licensure webpage to determine whether our program meets the educational requirements in the state(s) they wish to practice. To discuss the process of obtaining a CPA license in a particular state, please contact Admissions at [email protected] or 818-252-5221. For a general overview of CPA licensing requirements by U.S. state and territory, students may contact an individual state board of accountancy or visit This Way to CPA, state requirements.