Dr. Alice Shiotsugu Presents on Importance of Taxes for Financial Sustainability Program

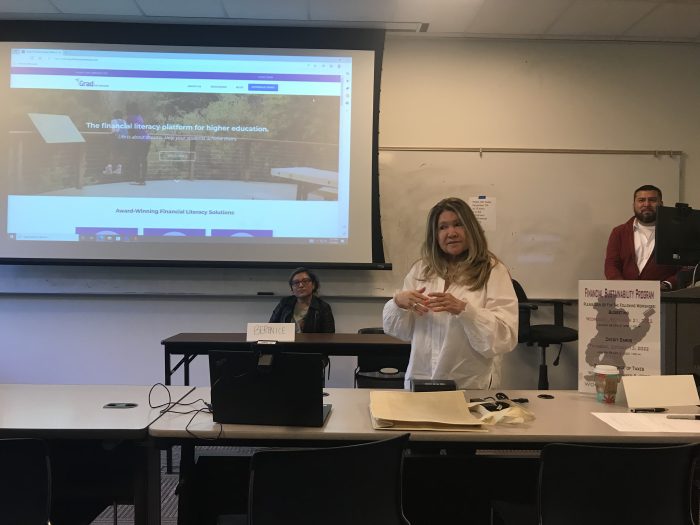

On Wednesday, November 9, 2022, School of Business faculty member and Accounting department co-coordinator, Dr. Alice Shiotsugu, gave a presentation on “The Importance of Taxes- Fill Your Toolbox with Skills for College Success” as part of a workshop for Woodbury’s Financial Sustainability Program. The workshop, which was facilitated by Issac Morales, Financial Coach and School of Business student, and Esteban Blas, Financial Advisor and School of Business Alum, aimed to help students, faculty, and staff better understand personal taxation, tax myths, and the proper uses for different types of tax forms.

During her presentation, Dr. Shiotsugu, a licensed CPA with over 21 years of experience at the IRS, explained who is required to pay taxes under the law. Dr. Shiotsugu also explained the importance of taxpayers ensuring that they understand the law and that they file their taxes on time to avoid stiff penalties. She emphasized that ignorance of the law does not make people exempt from paying their taxes and encouraged attendees to go to the IRS’ website (www.irs.gov) to read the latest laws and ensure that they are complying. Dr. Shiotsugu also covered matters relevant to students, such as whether scholarships and student loans are taxable. She explained that scholarships are not taxable unless the scholarship money is used for purposes other than tuition/books, supplies, and equipment. She also explained that student loans are generally not taxable, unless the loans are not repaid, and the debt is forgiven by COD (Common Origination & Disbursement).

In addition to explaining the importance of understanding and paying taxes, Dr. Shiotsugu was also joined by two Accounting students, Jose Arevalo and Berenice Hernandez, to discuss the Volunteer Income Tax Assistance (VITA) Program, which will return to the School of Business in the Spring following a hiatus due to the COVID-19 pandemic. VITA coordinator Jose Arevalo explained that VITA is a partner program with the IRS where low-to-moderate income individuals making $57,000 per year or less, people with disabilities, and the elderly can receive free income tax preparation services. VITA co-coordinator, Berenice Hernandez, then went on to explain that VITA volunteers received training on tax preparation from Dr. Shiotsugu during the month of October and will also attend tax preparation training sessions put on by the IRS. Additionally, all volunteers who will be preparing taxes are required to take an examination and receive a certification to be eligible to prepare taxes. The program is also currently looking for volunteers who can assist with administrative services. VITA services will be held every Saturday from February 4, 2023, through April 8, 2023, with more information to be made available in the coming weeks.

Last Updated on November 18th, 2022.